Success is an Outlier. Failure is a Pattern.

We don’t sell a map to the treasure; we sell a map of the minefield.

Fractional Corporate Development & Capital Strategy for Life Sciences Companies.

USD $15M+

Capital Strategy

Equity + Non-Dilutive Funding Secured

50%

Burn Rate Cut

Series B Scale-up

100%

MoM Growth

Post-Optimization

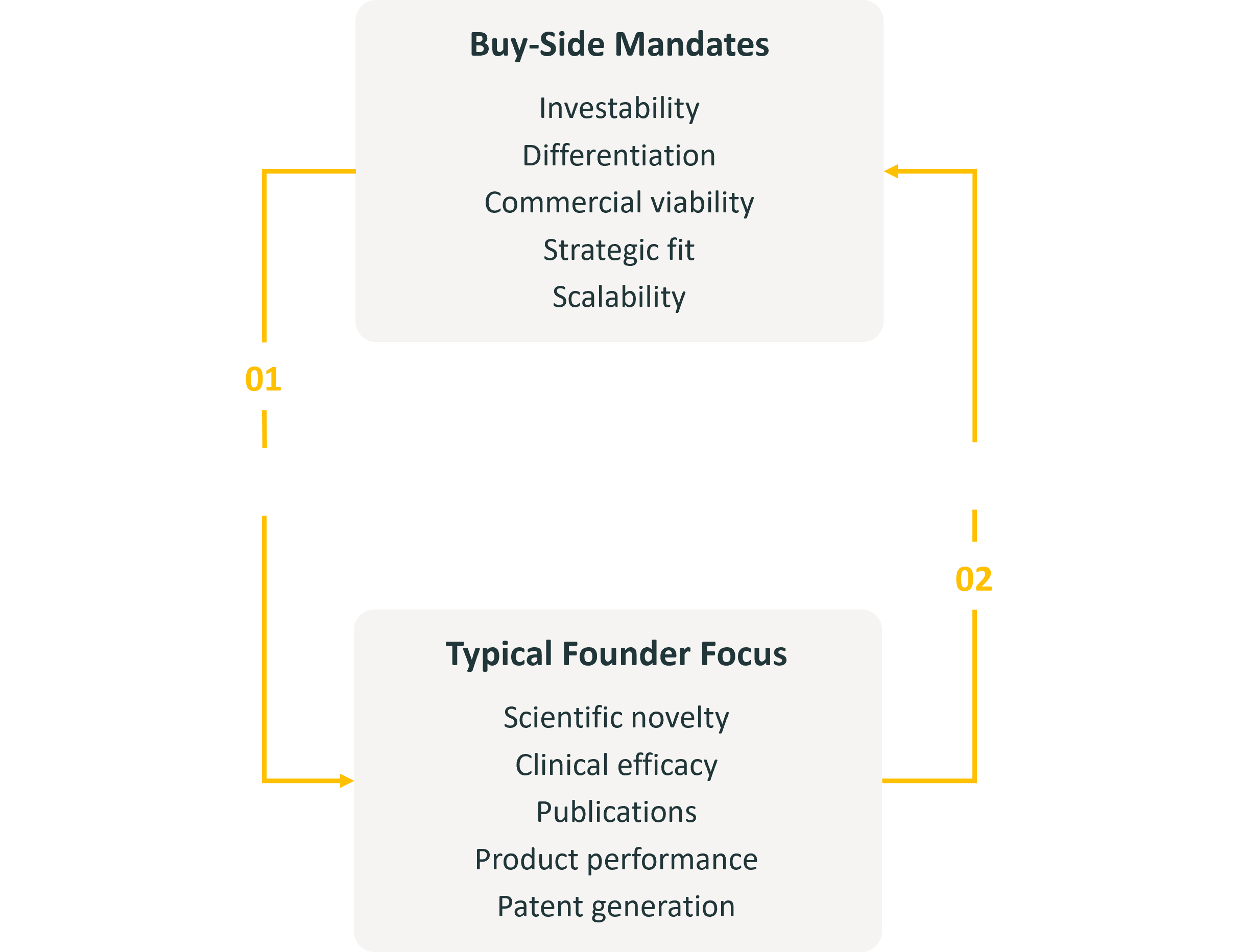

We Build with the Buy-Side in Mind

Most startups fail because they focus only on the science.

We reverse-engineer your roadmap based on what Investors and Acquirers actually buy.

Capital Strategy

We move beyond simple fundraising. We orchestrate dilutive and non-dilutive funding architectures (seed to C + Government Grants) to extend runway and minimize founder dilution.

Focus: Valuation Defense, Investor Analysis & Outreach.

M&A/Exit Readiness

We stress-test your assets against buy-side due diligence criteria (IP, Market Availability, Scalability) long before you enter the data room. We turn "deal killers" into structural assets.

Focus: Strategic Partnership Analysis & Outreach, Commercial Narrative.

Fractional Leadership

Advice is cheap; execution is rare. We embed as interim C-Suite operators, driving burn-rate efficiency and commercial traction without the friction of a full-time hire.

Focus: Burn Rate Reduction, Pipeline & R&D Optimization

The mustardseed. Edge

We bridge the gap between the Investors’ mandate and the Founder's reality.

We don’t sell theory; we sell scar tissue. Having navigated the "valley of death" firsthand, we have learned the hard lessons that kill most startups. We know exactly what the cliff edge looks like — and how to keep you from falling off it.

Combining this grit with buy- and sell-side experience, we now help founders secure capital and strategic partnerships, ensuring you build an asset engineered to survive and thrive.

Andrew Li - Founder & Managing Director